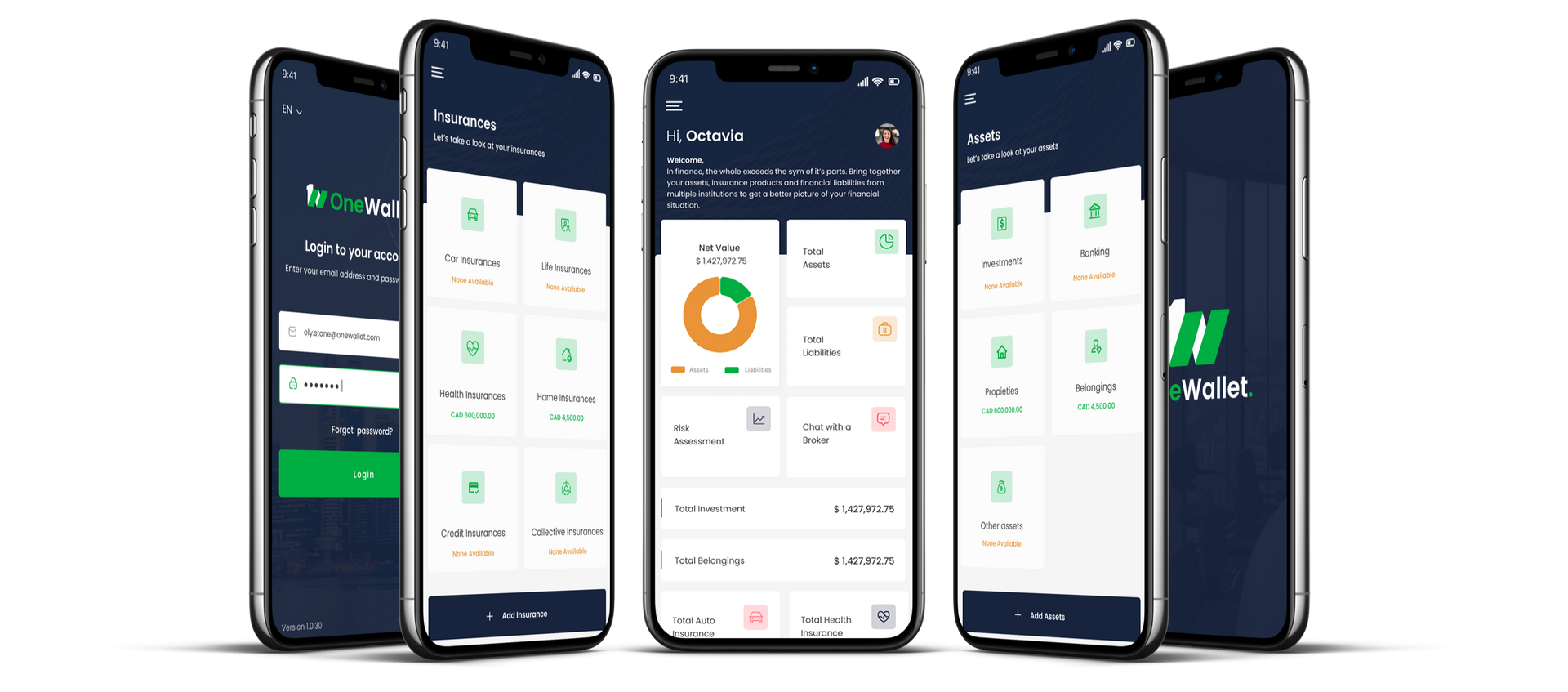

How OneWallet Revolutionizes Insurance for Financial Advisors: Real-Time Insights to Ensure Proper Coverage

In the fast-paced world of financial advising, ensuring that your clients have the right insurance coverage is a critical aspect of building trust and securing their financial future. Yet, one of the most significant challenges advisors face is identifying whether clients are underinsured, overinsured, or perfectly aligned with their insurance needs. This is where OneWallet steps in to transform how advisors assess, recommend, and manage client coverage.

Understanding the Insurance Gap

The concept of being underinsured is more common than many realize. Studies consistently show that a large portion of clients lack sufficient insurance coverage to protect their families or meet their financial goals in the event of unforeseen circumstances.

Here’s why this happens:

- Life Changes Go Unaddressed: Major life events like a new job, a baby, or buying a home often alter insurance needs, but these updates are not always reflected in a client’s coverage.

- Complex Financial Profiles: Clients with multiple income streams, dependents, debts, and assets can have a hard time understanding exactly how much insurance they need.

- Limited Client Engagement: Advisors don’t always have access to real-time updates about their clients' changing circumstances, making it challenging to recommend the right coverage.

The consequences of underinsurance can be devastating—for clients, their families, and even the advisor’s reputation.

How OneWallet Addresses the Problem

At OneWallet, we’ve built a platform designed to tackle the issue of underinsurance and over insurance by giving advisors the tools they need to offer the perfect level of coverage for every client.

1. Real-Time Client Analysis

OneWallet collects and analyzes real-time data from your clients through our client-facing portal. This data includes:

- Salary and income streams

- Family details, including dependents and spouse financial information

- Debts and assets

- Financial goals and long-term plans

By keeping this information up to date, our platform calculates an ideal insurance figure tailored to each client’s unique situation.

2. Spotting Underinsured Clients

OneWallet doesn’t just identify underinsured clients—it highlights exactly why they are underinsured. For instance:

- A new parent may not have adjusted their life insurance after the birth of their child.

- A homeowner might have increased debt from a new mortgage but no additional coverage to match.

- A high earner might lack sufficient income replacement coverage in case of disability.

When the platform detects gaps in coverage, it automatically generates an opportunity alert for the advisor.

3. Automating Opportunity Creation

Once an underinsurance gap is identified, OneWallet takes it a step further:

- Personalized Recommendations: The platform suggests specific products that fit the client’s needs, from term life insurance to critical illness coverage.

- One-Click Proposals: Advisors can send pre-filled proposals directly to clients with a single click, simplifying the process of offering new coverage options.

- Seamless Client Approval: Clients can review, accept, and initiate policy changes directly through the platform, streamlining the workflow for both parties.

Why Underinsurance Is a Problem for Everyone

Failing to address underinsurance has negative impacts on clients, their families, and even financial advisors. Here’s why:

For Clients

- Financial Vulnerability: Underinsured clients risk financial hardship if a major life event occurs, such as the death of a breadwinner or a severe illness.

- Unmet Goals: Insufficient coverage can derail long-term financial goals like sending children to college or paying off a mortgage.

For Advisors

- Missed Opportunities: Every underinsured client represents a missed opportunity to grow your business while protecting your client.

- Erosion of Trust: Advisors who fail to identify coverage gaps may lose credibility with their clients over time.

- Compliance Risks: Inadequate coverage may lead to disputes or regulatory scrutiny.

Balancing the Equation: Identifying Over insured Clients

While underinsurance is a pressing issue, over insurance can also negatively impact clients:

- Unnecessary Premium Costs: Over insured clients may be paying for policies they don’t need, straining their finances unnecessarily.

- Reduced Client Satisfaction: Advisors recommending excessive coverage can lose the trust of clients looking for personalized advice.

OneWallet helps balance this equation by ensuring every client has just the right amount of coverage. By analyzing their financial situation and long-term goals, the platform highlights when a client may be over insured and provides recommendations for optimizing their policies.

The OneWallet Advantage

With OneWallet, advisors gain access to a range of tools that make it easier to serve their clients effectively:

1. Data-Driven Insights

Our real-time data collection ensures that you’re always working with the most up-to-date information about your clients.

2. Simplified Processes

Automated recommendations and one-click proposals eliminate the back-and-forth of traditional insurance sales, saving time for both you and your clients.

3. Enhanced Client Relationships

By proactively addressing gaps in coverage, you demonstrate your commitment to your clients’ financial well-being, building trust and loyalty over time.

4. Increased Revenue Opportunities

Spotting underinsured clients and presenting personalized solutions opens up new revenue streams while ensuring your clients are fully protected.

A Better Way to Serve Your Clients

OneWallet isn’t just about selling insurance—it’s about empowering advisors to provide the best possible service to their clients.

By ensuring that every client has the right coverage for their unique circumstances, you protect their financial future while growing your own business.

Ready to Learn More?

Discover how OneWallet can transform your practice. Schedule a demo today and see how our platform can help you identify underinsured clients, optimize their coverage, and build stronger relationships.

With OneWallet, you’ll always have the tools you need to serve your clients better and ensure they’re always protected.