How technology is transforming the insurance advisory business

The insurance advisory industry is currently experiencing one of the most significant transformations in its history, driven by rapid advancements in technology. From artificial intelligence (AI) to big data, insurance companies and advisors are finding new ways to streamline their operations, deliver personalized advice, and improve the customer experience. As InsurTech continues to rise, the pressure to adopt these innovations has never been higher, leaving those who resist at risk of falling behind in an increasingly digital landscape.

In this article, we explore how technology is revolutionizing the insurance advisory business, highlighting key trends, challenges, and opportunities that advisors and companies face today.

1. Key Trends in InsurTech

The insurance industry has traditionally been slow to adopt new technologies, but that’s changing with the rise of InsurTech—the integration of technology with insurance services to improve processes, reduce costs, and enhance the customer experience. InsurTech companies are developing tools that provide digital solutions to legacy challenges, such as slow claims processing, manual underwriting, and outdated customer engagement models.

Some of the key trends driving transformation in the insurance sector include:

- Customer-Centric Solutions: InsurTech platforms are designed with a focus on the customer experience. They allow clients to interact with insurance companies through digital channels, making it easier to file claims, update policies, and receive instant quotes. This not only improves customer satisfaction but also builds brand loyalty.

- Data-Driven Decision-Making: The integration of big data into insurance advisory allows advisors to make more informed decisions by analyzing vast datasets about customer behavior, risk profiles, and market trends. With predictive analytics, advisors can anticipate client needs, offer personalized product recommendations, and mitigate risk more effectively.

- Automation of Administrative Tasks: One of the most significant changes in the insurance industry is the automation of manual processes. Tasks like policy management, claims processing, and document handling are now streamlined through AI and machine learning tools. This allows insurance advisors to spend more time building relationships with clients and less time on paperwork.

By leveraging these trends, insurance companies and advisors are able to create a more efficient, customer-focused business model that is well-equipped to compete in today’s market.

2. The Role of AI and Machine Learning in Insurance

Artificial intelligence (AI) and machine learning are among the most transformative technologies in the insurance sector today. By integrating AI, insurance companies and advisors are not only improving their operational efficiency but also enhancing the level of service they can provide to clients.

- Automating Risk Assessments: AI-powered algorithms can analyze vast amounts of data, including customer histories, current market conditions, and economic indicators, to automate risk assessments. These systems are much faster and more accurate than traditional methods, reducing errors and speeding up the underwriting process.

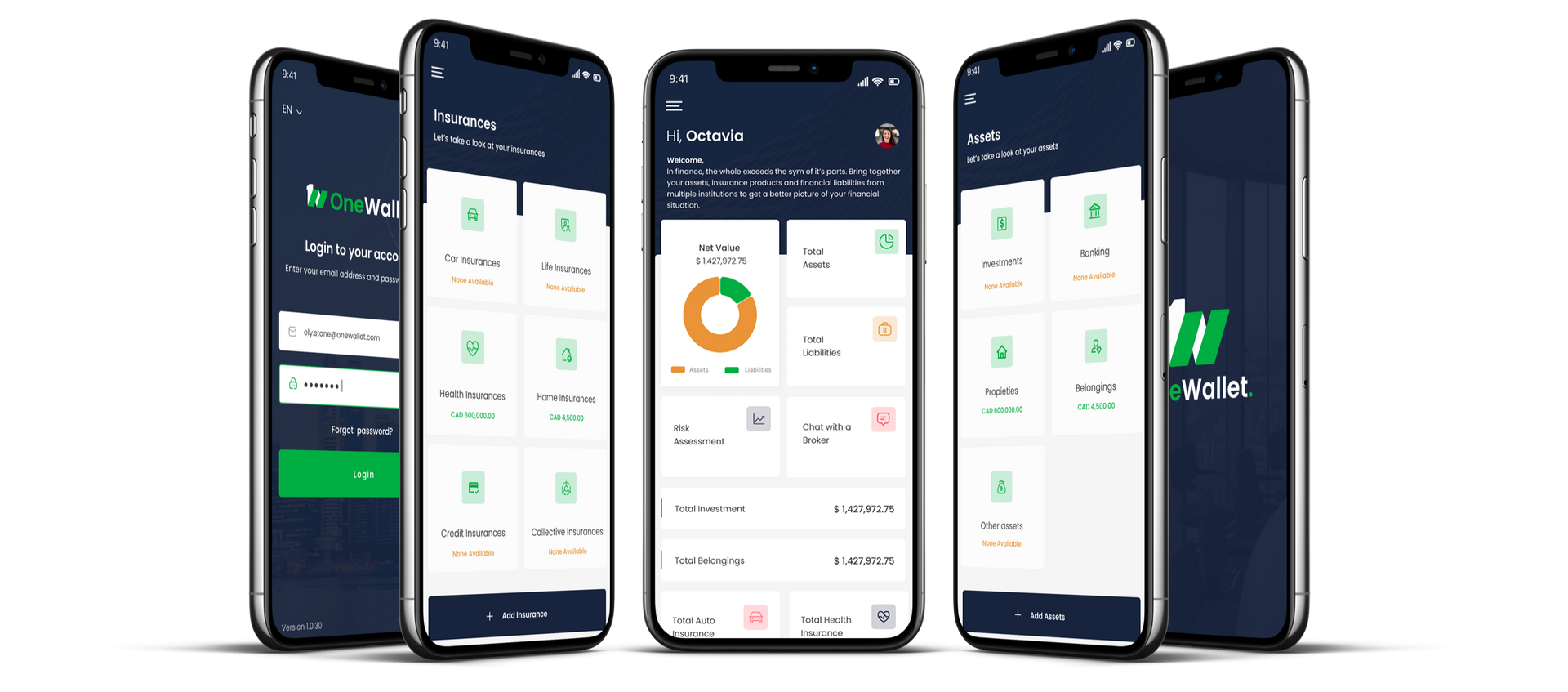

- Real-Time Data for Advisors: Advisors can now access real-time data from clients, enabling them to offer better, more tailored advice. For example, when clients update their financial or personal information, platforms like OneWallet capture these changes immediately, allowing advisors to recommend relevant insurance or investment products that reflect the client’s current needs.

- Fraud Detection and Prevention: One of the most significant advantages of AI is its ability to detect fraudulent activities. Machine learning algorithms can identify unusual patterns in claims or policy applications, flagging potential fraud before it becomes a costly problem. This enhances the overall security and trustworthiness of insurance companies.

AI is not only making the insurance advisory process more efficient but also helping companies offer more personalized and secure services to their clients.

3. Big Data Analytics in the Insurance Industry

In today’s digital economy, big data is becoming a crucial asset for the insurance industry. By collecting and analyzing vast datasets, insurance advisors and companies can unlock new insights into client behaviors, market trends, and operational efficiency.

- Enhancing Risk Management: One of the key applications of big data in the insurance sector is predictive analytics, which enables advisors to predict client needs and market shifts. This data can be used to design better products, tailor recommendations, and improve overall risk management strategies.

- Improving Claims Processing: Big data analytics helps to improve the efficiency and accuracy of claims processing. By analyzing data from previous claims, insurance companies can identify patterns and develop automated systems that reduce the time and cost of claims management. For instance, insurers can now process simple claims in minutes using machine learning algorithms, freeing up human resources to handle more complex cases.

- Tailoring Client Experiences: With access to large amounts of customer data, insurance advisors can now offer more personalized services. For example, if a client’s financial situation changes, their advisor can quickly adjust their insurance coverage to reflect these new circumstances. This customer-centric approach helps build stronger relationships between advisors and their clients, leading to increased satisfaction and loyalty.

Through the application of big data, insurance companies and advisors can deliver a more personalized, efficient, and risk-aware service.

4. The Role of Digital Platforms and Real-Time Customer Interactions

As technology evolves, digital platforms are becoming the cornerstone of modern insurance advisory. These platforms offer insurance advisors the tools to manage clients, policies, and claims in real time, creating a seamless and highly responsive service model.

- Real-Time Customer Interactions: One of the most notable advantages of digital platforms is the ability to interact with clients in real time. For instance, platforms like OneWallet allow clients to update their information, view policy details, and communicate with their advisor instantly. This level of immediacy improves transparency and ensures that clients are always informed.

- Customizable Insurance Policies: Digital platforms also enable advisors to offer more flexible, customizable insurance solutions. Clients can adjust their coverage, add riders, or modify policy terms through an online platform, giving them greater control over their insurance experience. This customization leads to higher customer satisfaction, as clients can tailor their coverage to suit their individual needs.

- Efficient Policy Management: For insurance advisors, digital platforms streamline policy management by automating routine tasks such as document storage, claims submission, and policy renewals. This reduces administrative burdens and allows advisors to focus on building meaningful client relationships.

By adopting digital platforms, insurance advisors are not only improving operational efficiency but also enhancing the overall client experience through real-time interactions and flexible solutions.

5. Challenges and Opportunities in the InsurTech Landscape

While the rise of InsurTech presents numerous opportunities for insurance advisors, it also introduces a set of challenges that companies must navigate to remain competitive.

- Regulatory Compliance: As more customer data is collected and processed digitally, regulatory compliance becomes a significant concern. Insurance companies must ensure that they meet all industry standards regarding data privacy, particularly as regulations like GDPR (General Data Protection Regulation) become more stringent.

- Legacy Systems: Many insurance firms still rely on legacy systems that are not compatible with modern technology. This creates a barrier to adopting new digital tools, as companies may be hesitant to replace or upgrade systems that have been in place for decades. The challenge lies in integrating new technologies without disrupting existing operations.

- Talent Shortages: Another challenge in the InsurTech space is the lack of talent with both insurance and technology expertise. As the industry becomes more reliant on digital platforms, AI, and big data, companies need employees who understand both the technical and business aspects of insurance.

Despite these challenges, the opportunities for growth are immense. By embracing digital transformation, insurance advisors can gain a competitive edge, offering more personalized, efficient, and customer-centric services.

Conclusion

The insurance advisory business is evolving rapidly, driven by the rise of InsurTech, AI, and big data. For advisors, the adoption of technology is no longer optional—it is essential to remaining competitive in a fast-changing market. By leveraging digital platforms, AI, and real-time data, advisors can offer more personalized, efficient, and client-focused services that meet the expectations of today’s consumers.

Platforms like OneWallet are leading the charge in this digital transformation, providing advisors with the tools they need to harness real-time data, streamline processes, and improve customer engagement. As the industry continues to evolve, those who embrace technology will thrive, while those who resist may be left behind.