By Marco Sylvestre

•

October 21, 2024

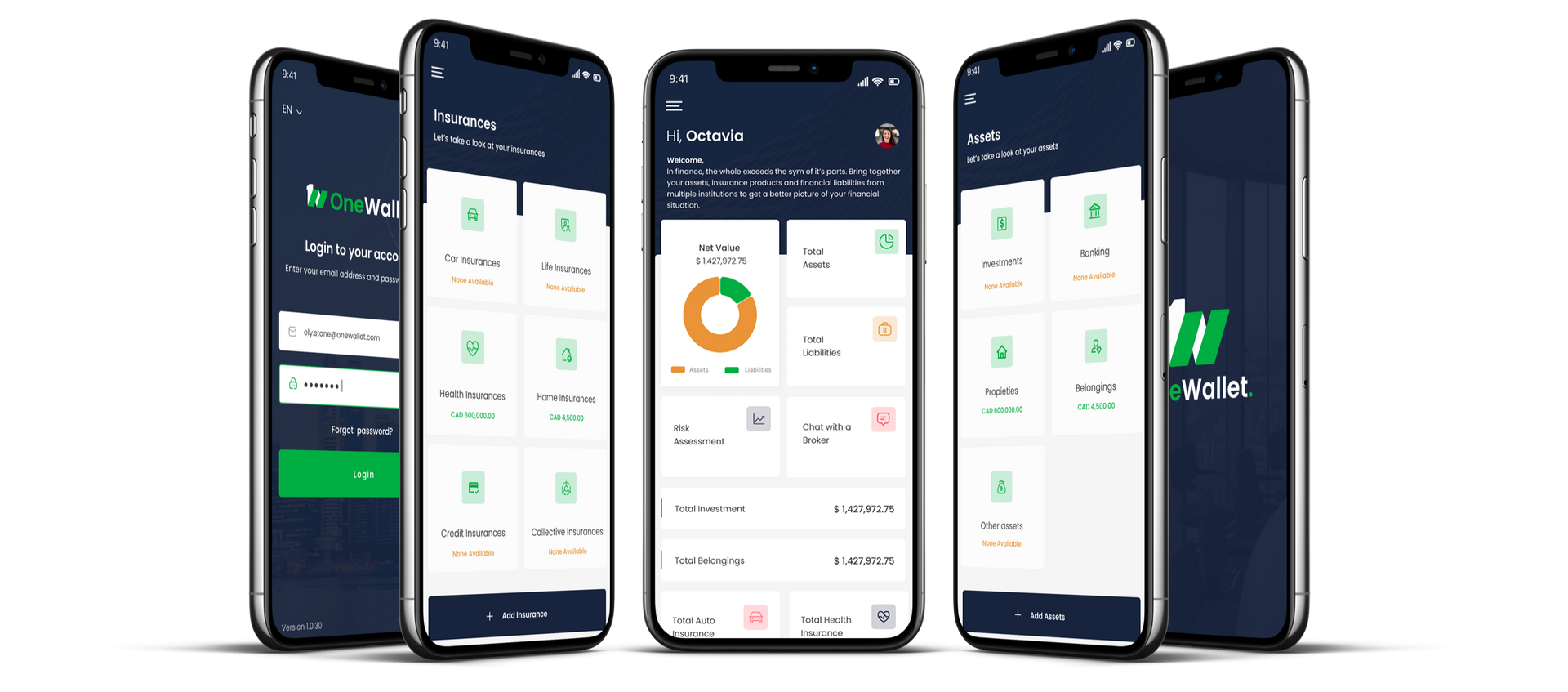

In today's rapidly evolving financial landscape, technology plays a pivotal role in how financial advisors interact with clients, manage portfolios, and grow their businesses. With clients expecting seamless digital experiences and real-time insights, advisors must embrace innovative solutions to stay competitive. One such solution is OneWallet, an advanced app that provides real-time client data and actionable recommendations, empowering advisors to deliver personalized services like never before. In this article, we'll explore how financial advisors can leverage technology, specifically through tools like OneWallet, to enhance client relationships, streamline operations, and stay ahead in the industry. The Evolution of Financial Advising The financial services industry has witnessed a significant transformation due to technological advancements. Traditional face-to-face meetings and paper-based processes are giving way to digital platforms that offer efficiency and convenience. Clients today are tech-savvy and expect instant access to information, personalized advice, and proactive communication from their advisors. According to the Bureau of Labor Statistics , employment for personal financial advisors is projected to grow 15% from 2021 to 2031, much faster than the average for all occupations. This growth underscores the importance of adapting to new technologies to meet increasing client demands. Why Are Financial Institutions Focusing on Digital Improvements? Financial institutions recognize that embracing technology is essential to remain competitive. Digital improvements lead to: Enhanced Client Experiences: Offering user-friendly platforms increases client satisfaction. Operational Efficiency: Automation reduces costs and errors associated with manual processes. Regulatory Compliance: Technology helps in adhering to complex financial regulations through automated checks. Impact of Technology on Client Expectations Technology has reshaped client expectations in several ways: Real-Time Access: Clients want immediate access to their financial data and investment performance. Personalized Advice: Generic advice is no longer sufficient; clients expect recommendations tailored to their unique financial goals and life situations. Convenient Communication: Clients prefer advisors who offer multiple communication channels, including mobile apps, secure messaging, and video conferencing. A survey by Investopedia found that 76% of investors expect personalized investment advice, highlighting the importance of technology in meeting these expectations. Introducing OneWallet: A Game-Changer for Financial Advisors OneWallet is a cutting-edge app designed to revolutionize how financial advisors interact with their clients. It offers: Real-Time Client Data: Access up-to-the-minute information on client portfolios, transactions, and financial activities. Personalized Recommendations: Utilize AI-driven insights to suggest products and services that align with clients' financial goals. Enhanced Client Engagement: Improve communication and build stronger relationships through a client-centric platform. Key Features of OneWallet Data Collection and Management: Simplify the onboarding process with digital forms and secure data collection, reducing administrative tasks and errors. Tailored Financial Plans: Generate customized financial strategies based on real-time data and predictive analytics. Secure Messaging: Communicate with clients through encrypted channels, ensuring confidentiality and compliance. Automated Portfolio Analysis: Receive automated alerts and insights on portfolio performance, market trends, and investment opportunities. Client Portal Access: Provide clients with a personalized portal where they can view their financial information, set goals, and track progress. How AI Helps Financial Advisors Artificial Intelligence (AI) is transforming the financial advisory industry by: Predictive Analytics: AI algorithms analyze market trends and client data to predict future outcomes. Risk Assessment: Evaluate investment risks more accurately to make informed decisions. Automated Customer Service: Implement chatbots for instant client support and queries. A report by Wealth Professional Canada indicates that AI is helping investment advisors better serve clients by providing deeper insights and enhancing efficiency. Enhancing Client Relationships with Technology Building and maintaining strong client relationships is crucial for long-term success. Technology facilitates this by: Understanding Client Needs: Analyze data to gain deeper insights into client preferences, risk tolerance, and financial objectives. Proactive Engagement: Use tools like OneWallet to anticipate client needs and reach out with timely advice or solutions. Measuring Satisfaction: Implement feedback mechanisms to gauge client satisfaction and identify areas for improvement. How Do Advisors Engage Prospects and Improve Interaction Quality? Financial advisors can enhance interactions with prospects by: Personalized Communication: Tailoring messages to address specific client concerns. Educational Content: Providing valuable resources that help clients make informed decisions. Digital Marketing Strategies: Utilizing social media, email campaigns, and webinars to reach a broader audience. According to a study by Umlaut Solutions , focusing on client goals during meetings leads clients to perceive advisors and their companies as more professional and engaged. Building and Engaging Your Client Base Growing a client base and keeping them engaged requires a strategic approach: Leverage Referrals: Satisfied clients are more likely to refer friends and family. Offer Value-Added Services: Providing additional services like financial education workshops can attract new clients. Maintain Regular Communication: Use technology to stay in touch with clients through newsletters, updates, and personalized messages. A study by the 2019 Netwealth AdviceTech report found that advisors using technology to facilitate the financial advice process saw a 44.9% increase in improved client engagement and communication, along with a 43.8% increase in client satisfaction. Streamlining Operations for Efficiency Technology not only enhances client interactions but also streamlines internal processes: Automation of Routine Tasks: Reduce time spent on administrative duties with automated data entry, scheduling, and reporting. Integration with CRM Systems: Sync client data across platforms to maintain consistency and improve accessibility. Regulatory Compliance: Utilize built-in compliance features to ensure adherence to industry regulations. According to Cerulli Associates , advisors considered heavy users of technology tend to outperform other advisory practices, emphasizing the importance of tech adoption. Future Trends in Financial Advising Technology Staying ahead requires awareness of emerging technologies that will shape the industry: Blockchain and Cryptocurrency: Understanding and integrating digital assets into client portfolios where appropriate. Enhanced Cybersecurity Measures: Protecting client data with advanced security protocols to maintain trust. Integration of Augmented Reality (AR) and Virtual Reality (VR): Exploring new ways to visualize data and interact with clients. Open Banking Initiatives: Facilitating seamless data sharing between financial institutions for improved client services. Preparing for a Digital-First Financial Landscape Advisors should: Invest in Continuous Learning: Stay updated on technological advancements and industry trends. Adopt Client-Centric Technologies: Focus on tools that enhance the client experience. Collaborate with Tech Providers: Partner with companies like OneWallet to implement innovative solutions. Conclusion: Embracing OneWallet for Superior Client Service In an industry where client expectations are continually rising, leveraging technology is no longer optional—it's imperative. Tools like OneWallet provide financial advisors with the capabilities to offer real-time, personalized advice, strengthen client relationships, and streamline operations. By embracing such technology, advisors not only meet current demands but also future-proof their practices against ongoing industry changes. Ready to transform your financial advisory practice? Discover how OneWallet can elevate your client engagement and operational efficiency. Learn more and schedule a demo today . By integrating OneWallet into your practice, you position yourself at the forefront of technological innovation, ready to meet the challenges and opportunities of a digital-first financial landscape. Embrace technology today to enhance your client relationships and drive your business growth.