Why Personalized Insurance Recommendations Are Key to Growing Your Client Base

Understanding the Shift in Insurance Expectations

The insurance industry has seen a massive shift in recent years. Today’s clients no longer accept standardized, one-size-fits-all policies. They expect personalized solutions tailored to their unique needs, risk profiles, and financial goals. This growing demand for personalized services has pushed insurers and advisors to adopt advanced technologies to deliver customer satisfaction and drive customer loyalty.

What Is Personalized Insurance and Why Does It Matter?

Personalized insurance tailors policies and recommendations to match the client’s individual circumstances. It uses detailed data to craft a policy or suggest products that address specific needs. Whether it’s identifying gaps in coverage or optimizing existing policies, personalized insurance is the path to better client relationships.

Why does this matter?

- Enhances trust: Clients feel valued and understood.

- Increases retention: Satisfied clients are more likely to renew policies.

- Drives growth: Tailored recommendations lead to upselling and cross-selling opportunities.

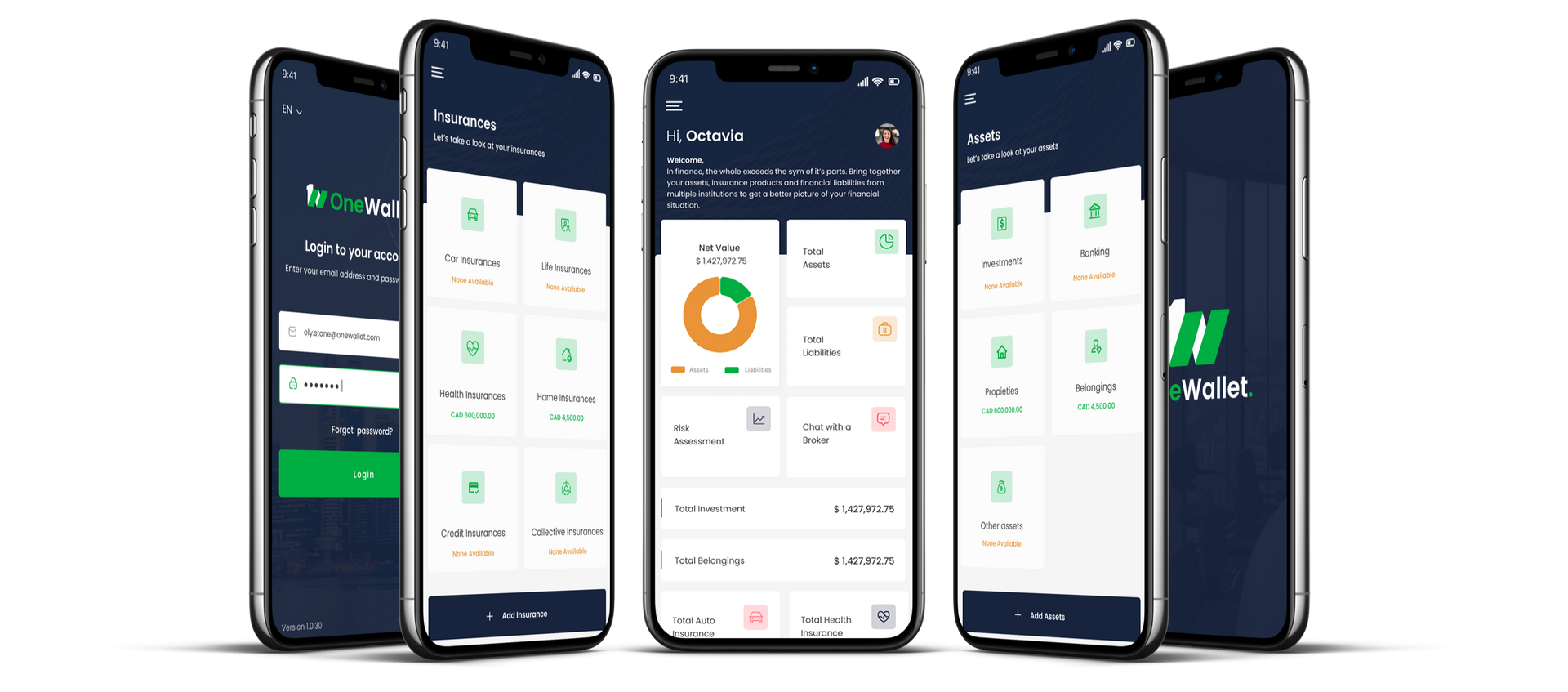

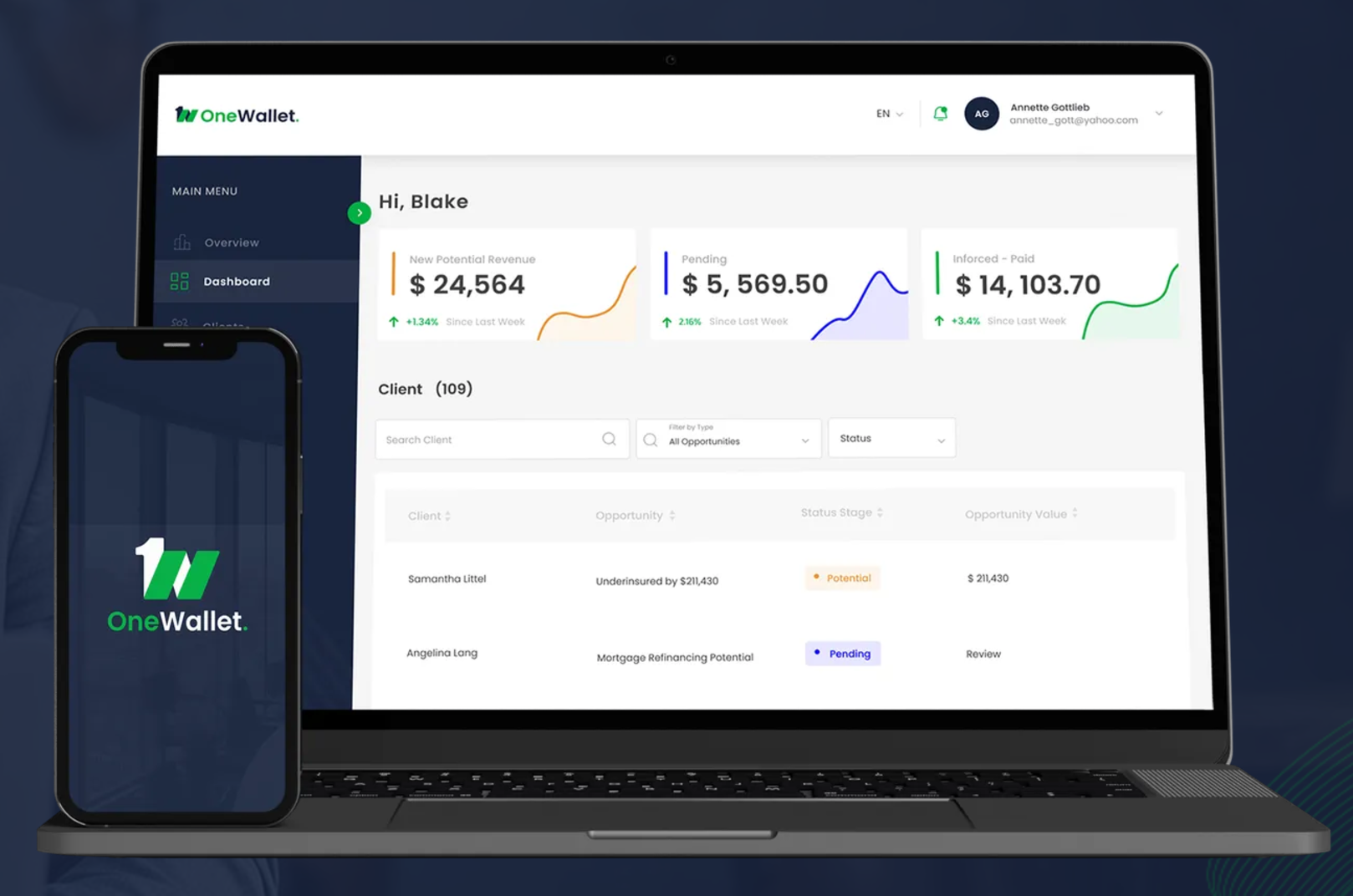

How OneWallet Leverages Technology for Personalization

OneWallet empowers financial advisors to harness advanced technologies like AI and predictive analytics. Our system gathers and analyzes client data in real-time, offering actionable insights. By integrating these tools, advisors can:

- Streamline client data collection through intuitive surveys.

- Use predictive analytics to assess insurance needs.

- Automate recommendations based on customer profiles and risk assessments.

This combination of tools allows advisors to offer personalized experiences at scale.

The Role of Advanced Technologies in Modern Insurance

Advanced technologies such as AI, predictive analytics, and mobile apps have become indispensable in the insurance industry. Here’s how they work together:

- AI for Opportunity Detection: AI identifies opportunities by analyzing patterns in customer data, such as missing coverage or potential risks.

- Mobile Apps for Accessibility: Clients can access their information and interact with advisors conveniently through mobile apps, ensuring an optimal customer experience.

- Predictive Analytics for Decision Making: Advisors can anticipate future client needs, from retirement planning to life insurance adjustments.

By utilizing these technologies, OneWallet ensures that both advisors and clients benefit from efficient and personalized services.

Why Clients Are Often Underinsured and How to Fix It

One of the most pressing challenges in the insurance industry is underinsured clients. Many people underestimate their insurance needs due to a lack of awareness or understanding of the products available.

Why is this bad for clients?

- Financial vulnerability during emergencies.

- Missed opportunities to protect assets.

- Misaligned coverage with life goals.

How OneWallet helps:

- Aggregates data on assets, liabilities, and life circumstances.

- Identifies gaps in coverage.

- Recommends optimal policies tailored to client profiles.

Addressing Overinsurance: A Hidden Problem

While underinsurance gets a lot of attention, overinsurance can also harm clients. Paying for unnecessary coverage leads to dissatisfaction and a lack of trust in their advisor.

With OneWallet’s advanced analytics, advisors can:

- Pinpoint areas where clients are overinsured.

- Suggest more efficient and cost-effective coverage options.

- Build client trust by focusing on their best interests.

This balanced approach ensures advisors strengthen long-term relationships with their clients.

How Personalized Recommendations Drive Client Engagement

Personalized recommendations are not just about policies; they are about building meaningful client relationships. With OneWallet, advisors can:

- Engage proactively: AI highlights key opportunities, such as upcoming policy renewals or significant life changes like a new job or a new child.

- Deliver value: Tailored recommendations show clients that their advisor is looking out for their best interests.

- Enhance communication: Pre-built email templates and surveys allow advisors to reach clients with ease.

This leads to a more engaged, loyal client base.

Creating a Competitive Edge Through Personalization

Personalized insurance is no longer just a trend; it’s a necessity. Advisors who fail to adopt personalization risk losing clients to competitors offering better experiences. OneWallet helps advisors stay ahead by:

- Offering unique insights: Aggregating data from 450+ insurance products.

- Streamlining workflows: Automating data collection and recommendation generation.

- Improving client retention: Enhancing customer satisfaction through tailored solutions.

This ensures that advisors remain competitive in a rapidly evolving industry.

Data Privacy: A Key Pillar of Personalized Insurance

As personalized insurance relies heavily on data, privacy is paramount. OneWallet prioritizes data security by:

- Ensuring all client information is encrypted.

- Following compliance regulations to maintain trust.

- Offering transparency in how data is used.

This reassures clients that their sensitive information is protected while enjoying the benefits of personalized services.

Building Long-Term Relationships with Tailored Solutions

The ultimate goal of personalized insurance is to build long-term client relationships. By consistently meeting client expectations and adapting to their evolving needs, advisors can:

- Strengthen customer trust.

- Enhance loyalty through exceptional service.

- Drive referrals and grow their client base.

OneWallet’s platform is designed to facilitate this by keeping clients at the center of every decision.

The Future of Insurance Lies in Personalization.

The insurance industry is moving toward a more customer-centric approach, driven by technologies like AI and predictive analytics. Advisors who adopt personalized insurance solutions will not only meet but exceed client expectations. With OneWallet, advisors gain access to tools that simplify their workflows, enhance customer experiences, and drive growth.

Why wait? Embrace personalization today and set yourself apart in the competitive world of insurance. OneWallet is here to help you lead the way.