Blog

L’industrie des services financiers est en pleine transformation. Avec l’essor de l’intelligence artificielle (IA) et l’accès à des données en temps réel, les conseillers financiers ont désormais des outils puissants pour offrir un service personnalisé, anticiper les besoins de leurs clients et renforcer leurs relations. Chez OneWallet , nous croyons que l’avenir repose sur l’innovation technologique, et voici pourquoi. 1. Des recommandations ultra-personnalisées L’époque des solutions génériques est révolue. Grâce à l’IA, les conseillers financiers peuvent désormais offrir des recommandations adaptées aux besoins uniques de chaque client . L’IA analyse en temps réel les données clés : revenu, objectifs financiers, dettes, actifs, etc. Elle suggère les produits financiers ou d’assurance les mieux adaptés. Elle s’ajuste automatiquement aux changements dans le profil du client (nouvel emploi, mariage, naissance, etc.). Exemple : Si un client reçoit une augmentation salariale, OneWallet identifie l’opportunité d’ajuster sa couverture d’assurance ou d’investir dans de nouveaux produits financiers. 2. Identification des opportunités cachées La technologie permet de détecter des opportunités qui pourraient facilement échapper à un conseiller. Avec l’analyse prédictive et l’automatisation des données , l’IA : Met en lumière des besoins non couverts, comme un client sous-assuré. Identifie les moments clés pour intervenir (renouvellement de police, anniversaires financiers, etc.). Hiérarchise les opportunités selon leur impact potentiel. Résultat : Les conseillers peuvent se concentrer sur les clients prioritaires et maximiser leur efficacité. 3. Une meilleure expérience client Les clients d’aujourd’hui s’attendent à une expérience fluide, intuitive et proactive. La technologie joue ici un rôle central : Les conseillers ont accès à des informations actualisées en temps réel pour mieux servir leurs clients. Les communications automatisées et personnalisées simplifient les échanges. Les plateformes modernes permettent aux clients de mettre à jour leurs données facilement via des applications conviviales. Pourquoi c’est crucial? Une expérience client améliorée favorise la fidélisation, la satisfaction et les références, des éléments essentiels pour la croissance d’une pratique financière. 4. Faciliter le quotidien des conseillers L’innovation technologique ne se limite pas aux clients : elle transforme aussi la vie des conseillers financiers. Automatisation des tâches administratives : moins de temps perdu sur les formalités. Analyse des données simplifiée : fini les tableaux complexes et les systèmes fragmentés. Prise de décision optimisée : des recommandations claires et précises basées sur l’IA. Avec des outils comme OneWallet, les conseillers peuvent consacrer plus de temps aux relations humaines et à la stratégie plutôt qu’à la gestion manuelle des dossiers. L’avenir commence maintenant L’année 2025 marque une opportunité unique pour les conseillers financiers d’adopter des outils modernes qui les aideront à : ✅ Mieux comprendre les besoins de leurs clients grâce aux données en temps réel. ✅ Délivrer des recommandations pertinentes et adaptées à chaque étape de la vie du client. ✅ Simplifier leur quotidien et devenir plus efficaces. Chez OneWallet , nous accompagnons les conseillers dans cette transformation. Nous croyons fermement que l’innovation technologique est la clé pour offrir un service exceptionnel et croître dans un marché en constante évolution. Êtes-vous prêt pour 2025? L’avenir est technologique, personnalisé et centré sur le client. Adoptez des outils comme OneWallet pour prendre une longueur d’avance et redéfinir la manière dont vous servez vos clients. Rejoignez-nous dans cette révolution. À propos de OneWallet OneWallet est une plateforme innovante qui utilise l’intelligence artificielle et les données en temps réel pour aider les conseillers financiers à identifier les opportunités, générer des recommandations personnalisées et offrir une expérience client exceptionnelle.

In the fast-paced world of financial advising, ensuring that your clients have the right insurance coverage is a critical aspect of building trust and securing their financial future. Yet, one of the most significant challenges advisors face is identifying whether clients are underinsured, overinsured, or perfectly aligned with their insurance needs. This is where OneWallet steps in to transform how advisors assess, recommend, and manage client coverage. Understanding the Insurance Gap The concept of being underinsured is more common than many realize. Studies consistently show that a large portion of clients lack sufficient insurance coverage to protect their families or meet their financial goals in the event of unforeseen circumstances. Here’s why this happens: Life Changes Go Unaddressed : Major life events like a new job, a baby, or buying a home often alter insurance needs, but these updates are not always reflected in a client’s coverage. Complex Financial Profiles : Clients with multiple income streams, dependents, debts, and assets can have a hard time understanding exactly how much insurance they need. Limited Client Engagement : Advisors don’t always have access to real-time updates about their clients' changing circumstances, making it challenging to recommend the right coverage. The consequences of underinsurance can be devastating—for clients, their families, and even the advisor’s reputation. How OneWallet Addresses the Problem At OneWallet , we’ve built a platform designed to tackle the issue of underinsurance and over insurance by giving advisors the tools they need to offer the perfect level of coverage for every client. 1. Real-Time Client Analysis OneWallet collects and analyzes real-time data from your clients through our client-facing portal. This data includes: Salary and income streams Family details, including dependents and spouse financial information Debts and assets Financial goals and long-term plans By keeping this information up to date, our platform calculates an ideal insurance figure tailored to each client’s unique situation. 2. Spotting Underinsured Clients OneWallet doesn’t just identify underinsured clients—it highlights exactly why they are underinsured. For instance: A new parent may not have adjusted their life insurance after the birth of their child. A homeowner might have increased debt from a new mortgage but no additional coverage to match. A high earner might lack sufficient income replacement coverage in case of disability. When the platform detects gaps in coverage, it automatically generates an opportunity alert for the advisor. 3. Automating Opportunity Creation Once an underinsurance gap is identified, OneWallet takes it a step further: Personalized Recommendations : The platform suggests specific products that fit the client’s needs, from term life insurance to critical illness coverage. One-Click Proposals : Advisors can send pre-filled proposals directly to clients with a single click, simplifying the process of offering new coverage options. Seamless Client Approval : Clients can review, accept, and initiate policy changes directly through the platform, streamlining the workflow for both parties.

Understanding the Shift in Insurance Expectations The insurance industry has seen a massive shift in recent years. Today’s clients no longer accept standardized, one-size-fits-all policies. They expect personalized solutions tailored to their unique needs, risk profiles, and financial goals. This growing demand for personalized services has pushed insurers and advisors to adopt advanced technologies to deliver customer satisfaction and drive customer loyalty. What Is Personalized Insurance and Why Does It Matter? Personalized insurance tailors policies and recommendations to match the client’s individual circumstances. It uses detailed data to craft a policy or suggest products that address specific needs. Whether it’s identifying gaps in coverage or optimizing existing policies, personalized insurance is the path to better client relationships. Why does this matter? Enhances trust : Clients feel valued and understood. Increases retention : Satisfied clients are more likely to renew policies. Drives growth : Tailored recommendations lead to upselling and cross-selling opportunities. How OneWallet Leverages Technology for Personalization OneWallet empowers financial advisors to harness advanced technologies like AI and predictive analytics. Our system gathers and analyzes client data in real-time, offering actionable insights. By integrating these tools, advisors can: Streamline client data collection through intuitive surveys. Use predictive analytics to assess insurance needs. Automate recommendations based on customer profiles and risk assessments. This combination of tools allows advisors to offer personalized experiences at scale. The Role of Advanced Technologies in Modern Insurance Advanced technologies such as AI, predictive analytics, and mobile apps have become indispensable in the insurance industry. Here’s how they work together: AI for Opportunity Detection : AI identifies opportunities by analyzing patterns in customer data, such as missing coverage or potential risks. Mobile Apps for Accessibility : Clients can access their information and interact with advisors conveniently through mobile apps, ensuring an optimal customer experience. Predictive Analytics for Decision Making : Advisors can anticipate future client needs, from retirement planning to life insurance adjustments. By utilizing these technologies, OneWallet ensures that both advisors and clients benefit from efficient and personalized services. Why Clients Are Often Underinsured and How to Fix It One of the most pressing challenges in the insurance industry is underinsured clients. Many people underestimate their insurance needs due to a lack of awareness or understanding of the products available. Why is this bad for clients? Financial vulnerability during emergencies. Missed opportunities to protect assets. Misaligned coverage with life goals. How OneWallet helps: Aggregates data on assets, liabilities, and life circumstances. Identifies gaps in coverage. Recommends optimal policies tailored to client profiles. Addressing Overinsurance: A Hidden Problem While underinsurance gets a lot of attention, overinsurance can also harm clients. Paying for unnecessary coverage leads to dissatisfaction and a lack of trust in their advisor. With OneWallet’s advanced analytics, advisors can: Pinpoint areas where clients are overinsured. Suggest more efficient and cost-effective coverage options. Build client trust by focusing on their best interests. This balanced approach ensures advisors strengthen long-term relationships with their clients. How Personalized Recommendations Drive Client Engagement Personalized recommendations are not just about policies; they are about building meaningful client relationships. With OneWallet, advisors can: Engage proactively : AI highlights key opportunities, such as upcoming policy renewals or significant life changes like a new job or a new child. Deliver value : Tailored recommendations show clients that their advisor is looking out for their best interests. Enhance communication : Pre-built email templates and surveys allow advisors to reach clients with ease. This leads to a more engaged, loyal client base. Creating a Competitive Edge Through Personalization Personalized insurance is no longer just a trend; it’s a necessity. Advisors who fail to adopt personalization risk losing clients to competitors offering better experiences. OneWallet helps advisors stay ahead by: Offering unique insights : Aggregating data from 450+ insurance products. Streamlining workflows : Automating data collection and recommendation generation. Improving client retention : Enhancing customer satisfaction through tailored solutions. This ensures that advisors remain competitive in a rapidly evolving industry. Data Privacy: A Key Pillar of Personalized Insurance As personalized insurance relies heavily on data, privacy is paramount. OneWallet prioritizes data security by: Ensuring all client information is encrypted. Following compliance regulations to maintain trust. Offering transparency in how data is used. This reassures clients that their sensitive information is protected while enjoying the benefits of personalized services. Building Long-Term Relationships with Tailored Solutions The ultimate goal of personalized insurance is to build long-term client relationships. By consistently meeting client expectations and adapting to their evolving needs, advisors can: Strengthen customer trust. Enhance loyalty through exceptional service. Drive referrals and grow their client base. OneWallet’s platform is designed to facilitate this by keeping clients at the center of every decision. The Future of Insurance Lies in Personalization. The insurance industry is moving toward a more customer-centric approach, driven by technologies like AI and predictive analytics. Advisors who adopt personalized insurance solutions will not only meet but exceed client expectations. With OneWallet, advisors gain access to tools that simplify their workflows, enhance customer experiences, and drive growth. Why wait? Embrace personalization today and set yourself apart in the competitive world of insurance. OneWallet is here to help you lead the way.

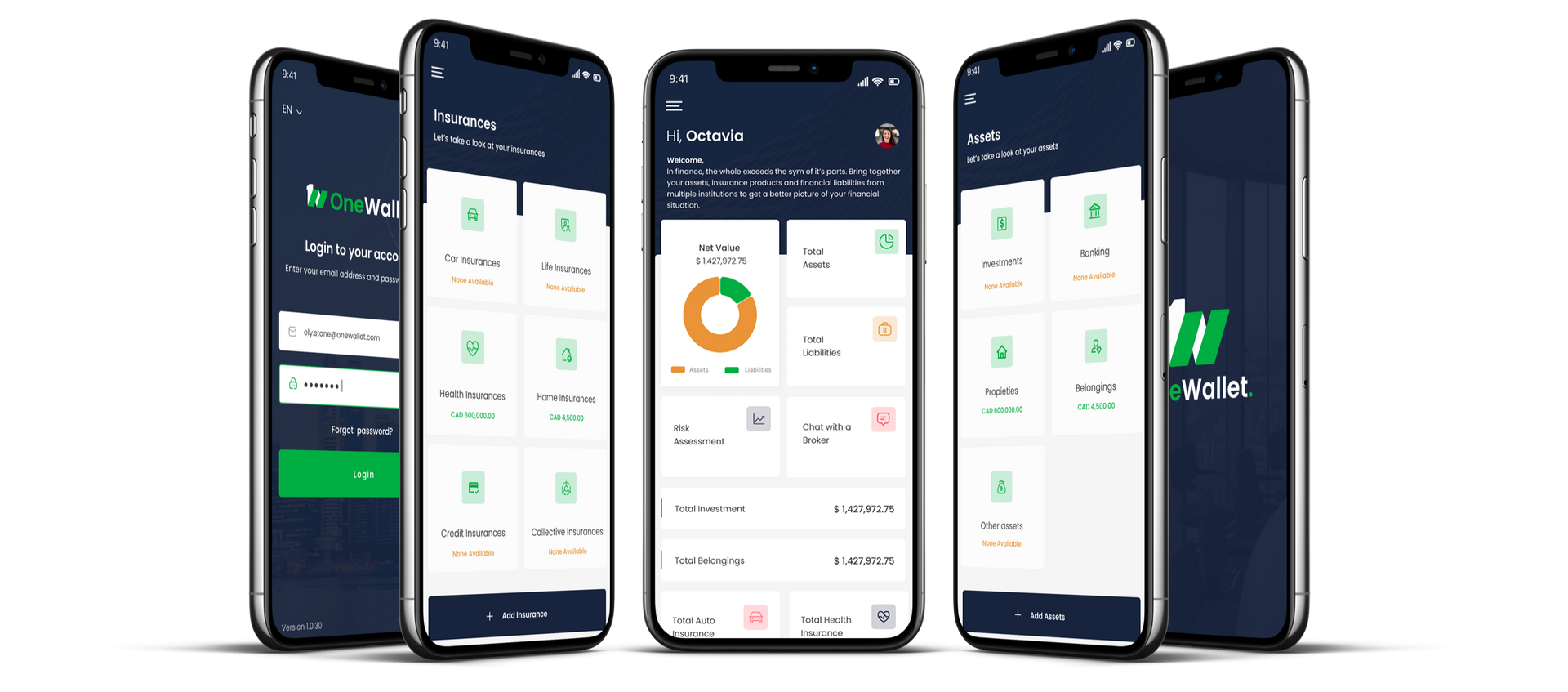

In today's rapidly evolving financial landscape, technology plays a pivotal role in how financial advisors interact with clients, manage portfolios, and grow their businesses. With clients expecting seamless digital experiences and real-time insights, advisors must embrace innovative solutions to stay competitive. One such solution is OneWallet, an advanced app that provides real-time client data and actionable recommendations, empowering advisors to deliver personalized services like never before. In this article, we'll explore how financial advisors can leverage technology, specifically through tools like OneWallet, to enhance client relationships, streamline operations, and stay ahead in the industry. The Evolution of Financial Advising The financial services industry has witnessed a significant transformation due to technological advancements. Traditional face-to-face meetings and paper-based processes are giving way to digital platforms that offer efficiency and convenience. Clients today are tech-savvy and expect instant access to information, personalized advice, and proactive communication from their advisors. According to the Bureau of Labor Statistics , employment for personal financial advisors is projected to grow 15% from 2021 to 2031, much faster than the average for all occupations. This growth underscores the importance of adapting to new technologies to meet increasing client demands. Why Are Financial Institutions Focusing on Digital Improvements? Financial institutions recognize that embracing technology is essential to remain competitive. Digital improvements lead to: Enhanced Client Experiences: Offering user-friendly platforms increases client satisfaction. Operational Efficiency: Automation reduces costs and errors associated with manual processes. Regulatory Compliance: Technology helps in adhering to complex financial regulations through automated checks. Impact of Technology on Client Expectations Technology has reshaped client expectations in several ways: Real-Time Access: Clients want immediate access to their financial data and investment performance. Personalized Advice: Generic advice is no longer sufficient; clients expect recommendations tailored to their unique financial goals and life situations. Convenient Communication: Clients prefer advisors who offer multiple communication channels, including mobile apps, secure messaging, and video conferencing. A survey by Investopedia found that 76% of investors expect personalized investment advice, highlighting the importance of technology in meeting these expectations. Introducing OneWallet: A Game-Changer for Financial Advisors OneWallet is a cutting-edge app designed to revolutionize how financial advisors interact with their clients. It offers: Real-Time Client Data: Access up-to-the-minute information on client portfolios, transactions, and financial activities. Personalized Recommendations: Utilize AI-driven insights to suggest products and services that align with clients' financial goals. Enhanced Client Engagement: Improve communication and build stronger relationships through a client-centric platform. Key Features of OneWallet Data Collection and Management: Simplify the onboarding process with digital forms and secure data collection, reducing administrative tasks and errors. Tailored Financial Plans: Generate customized financial strategies based on real-time data and predictive analytics. Secure Messaging: Communicate with clients through encrypted channels, ensuring confidentiality and compliance. Automated Portfolio Analysis: Receive automated alerts and insights on portfolio performance, market trends, and investment opportunities. Client Portal Access: Provide clients with a personalized portal where they can view their financial information, set goals, and track progress. How AI Helps Financial Advisors Artificial Intelligence (AI) is transforming the financial advisory industry by: Predictive Analytics: AI algorithms analyze market trends and client data to predict future outcomes. Risk Assessment: Evaluate investment risks more accurately to make informed decisions. Automated Customer Service: Implement chatbots for instant client support and queries. A report by Wealth Professional Canada indicates that AI is helping investment advisors better serve clients by providing deeper insights and enhancing efficiency. Enhancing Client Relationships with Technology Building and maintaining strong client relationships is crucial for long-term success. Technology facilitates this by: Understanding Client Needs: Analyze data to gain deeper insights into client preferences, risk tolerance, and financial objectives. Proactive Engagement: Use tools like OneWallet to anticipate client needs and reach out with timely advice or solutions. Measuring Satisfaction: Implement feedback mechanisms to gauge client satisfaction and identify areas for improvement. How Do Advisors Engage Prospects and Improve Interaction Quality? Financial advisors can enhance interactions with prospects by: Personalized Communication: Tailoring messages to address specific client concerns. Educational Content: Providing valuable resources that help clients make informed decisions. Digital Marketing Strategies: Utilizing social media, email campaigns, and webinars to reach a broader audience. According to a study by Umlaut Solutions , focusing on client goals during meetings leads clients to perceive advisors and their companies as more professional and engaged. Building and Engaging Your Client Base Growing a client base and keeping them engaged requires a strategic approach: Leverage Referrals: Satisfied clients are more likely to refer friends and family. Offer Value-Added Services: Providing additional services like financial education workshops can attract new clients. Maintain Regular Communication: Use technology to stay in touch with clients through newsletters, updates, and personalized messages. A study by the 2019 Netwealth AdviceTech report found that advisors using technology to facilitate the financial advice process saw a 44.9% increase in improved client engagement and communication, along with a 43.8% increase in client satisfaction. Streamlining Operations for Efficiency Technology not only enhances client interactions but also streamlines internal processes: Automation of Routine Tasks: Reduce time spent on administrative duties with automated data entry, scheduling, and reporting. Integration with CRM Systems: Sync client data across platforms to maintain consistency and improve accessibility. Regulatory Compliance: Utilize built-in compliance features to ensure adherence to industry regulations. According to Cerulli Associates , advisors considered heavy users of technology tend to outperform other advisory practices, emphasizing the importance of tech adoption. Future Trends in Financial Advising Technology Staying ahead requires awareness of emerging technologies that will shape the industry: Blockchain and Cryptocurrency: Understanding and integrating digital assets into client portfolios where appropriate. Enhanced Cybersecurity Measures: Protecting client data with advanced security protocols to maintain trust. Integration of Augmented Reality (AR) and Virtual Reality (VR): Exploring new ways to visualize data and interact with clients. Open Banking Initiatives: Facilitating seamless data sharing between financial institutions for improved client services. Preparing for a Digital-First Financial Landscape Advisors should: Invest in Continuous Learning: Stay updated on technological advancements and industry trends. Adopt Client-Centric Technologies: Focus on tools that enhance the client experience. Collaborate with Tech Providers: Partner with companies like OneWallet to implement innovative solutions. Conclusion: Embracing OneWallet for Superior Client Service In an industry where client expectations are continually rising, leveraging technology is no longer optional—it's imperative. Tools like OneWallet provide financial advisors with the capabilities to offer real-time, personalized advice, strengthen client relationships, and streamline operations. By embracing such technology, advisors not only meet current demands but also future-proof their practices against ongoing industry changes. Ready to transform your financial advisory practice? Discover how OneWallet can elevate your client engagement and operational efficiency. Learn more and schedule a demo today . By integrating OneWallet into your practice, you position yourself at the forefront of technological innovation, ready to meet the challenges and opportunities of a digital-first financial landscape. Embrace technology today to enhance your client relationships and drive your business growth.

Discover how OneWallet is revolutionizing the way financial advisors navigate their daily challenges. From consolidating fragmented financial data to enhancing client communication and ensuring compliance, learn how this innovative platform is empowering advisors to provide more personalized, efficient, and effective financial advice.